Parents: Paying for College

Helping Your Student Find Ways to Pay for College

When it comes to paying for college, it's important to have a plan. There are many sources of financial aid available, and the earlier your student starts saving and applying for aid, like grants and scholarships, the better. Use the tabs below to learn about different types of financial aid that may be available.

- Saving for College

- FAFSA

- Grants/Scholarships

- State Aid

- Work-Study

- Student Loans

Saving for College

It's never too late to start saving for college. Even a small amount tucked away each month can add up over time. The earlier you start saving, the more you'll have. Remember to keep your student's savings accounts under your name to help maximize the amount of federal financial aid for which your student may qualify.

You may also want to look into the Oklahoma 529 College Savings Plan, a tax-deferred program that can help you save money for your child's college education. For more information, visit ok4saving.org.

Some savings accounts accrue interest in your favor. Even without accounting for added interest, look how much you could save for your child's education just by saving $20 a month.

Age You Begin Saving |

$20 per month to age 18 |

$30 per month to age 18 |

$50 per month to age 18 |

$100 per month to age 18 |

Birth |

$4,320 |

$6,480 |

$10,800 |

$21,600 |

5 Years Old |

$3,120 |

$4,680 |

$7,800 |

$15,600 |

10 Years Old |

$1,920 |

$2,880 |

$4,800 |

$9,600 |

15 Years Old |

$720 |

$1,080 |

$1,800 |

$3,600 |

Next tab: "FAFSA"

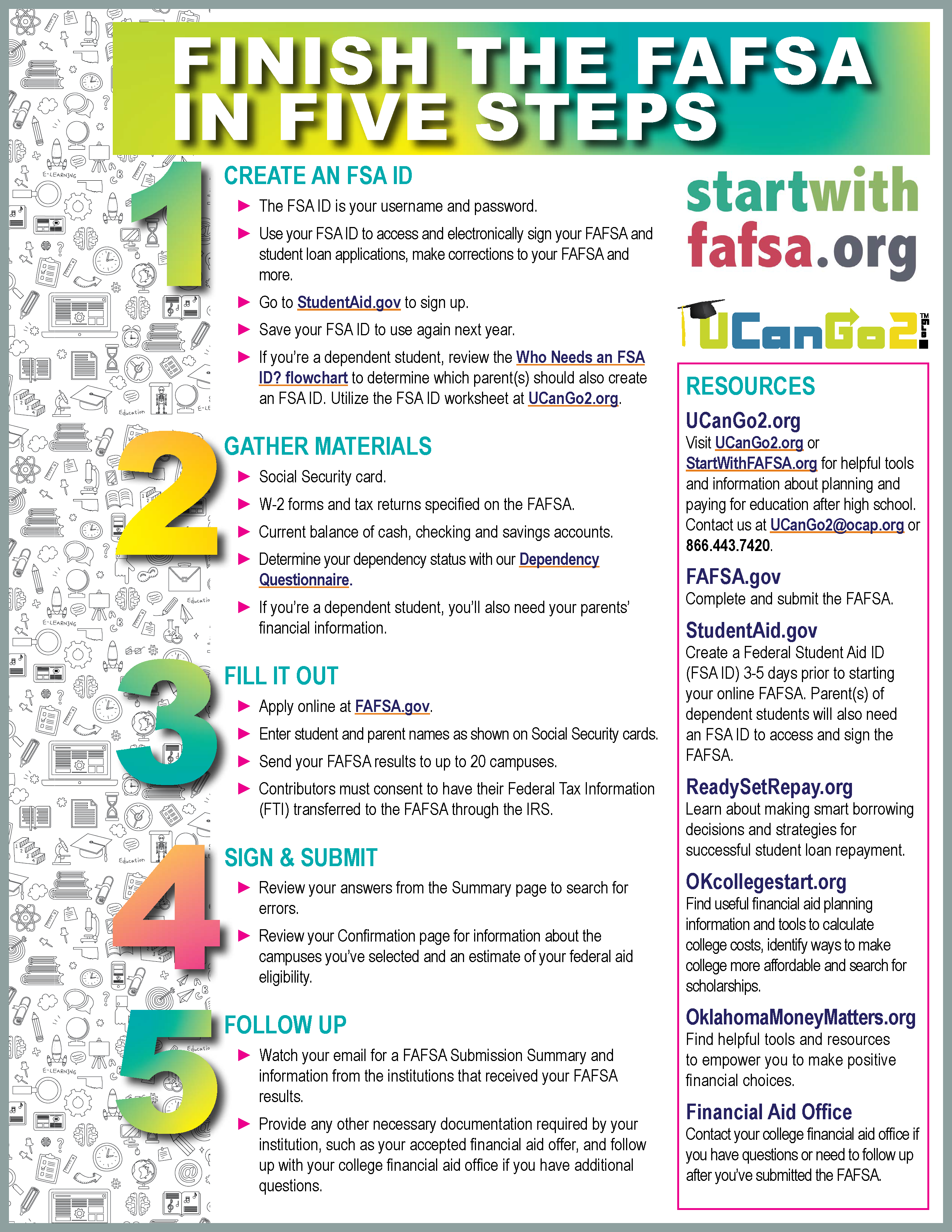

FAFSA

The first step for your child to receive any type of federal financial aid is to complete the Free Application for Federal Student Aid (FAFSA). Federal student aid includes grants, work-study opportunities and student loans. The FAFSA is also required for some scholarships. If your student isn't a senior in high school yet, you have some time before you'll need to complete the FAFSA.

If your student is a high school senior, you'll need to work together to submit the form this year to find out what federal and state financial aid options are available to them. If your student is considered a dependent student, you'll also need to provide your tax information to complete the form. To find out if your child is considered "dependent" or "independent" on the FAFSA, check out our Dependency Questionnaire.

Most importantly:

- Each year your child needs financial aid s/he should submit the FAFSA as soon as it becomes available, beginning with the senior year of high school. Remember, if your child is considered your dependent, they'll need your tax information to complete the FAFSA.

- The first letter in FAFSA stands for FREE. Never pay to complete the application.

- Even if you don't think your child will qualify for financial aid, s/he should submit the FAFSA anyway. Most students do qualify for some type of financial assistance for college.

- The easiest and most efficient way to complete the FAFSA is through the official FAFSA website, FAFSA.gov.

For more information about the FAFSA, including resources, publications and answers to your questions, visit us at StartWithFAFSA.org.

Next tab: "Grants/Scholarships"

Previous tab: "Saving for College"

Grants/Scholarships

We refer to grants and scholarships as "free money" or "gift aid" because it's money your child can use for college that won't have to be paid back. When looking for college funds, it’s best to seek free money before student loans.

We refer to grants and scholarships as "free money" or "gift aid" because it's money your child can use for college that won't have to be paid back. When looking for college funds, it’s best to seek free money before student loans.

Grants and scholarships are offered to college students for a variety of reasons, not just for perfect grades. And, they are available through many sources including the state, your child's college, private organizations and the federal government.

Encourage your child to check out local organizations that sponsor scholarships, such as church and community groups, for local and nationwide scholarships. Check out our scholarships page to search for scholarships by deadline or category.

Remember, scholarships are awarded based on a variety of criteria, including need, merit, residency, family history, skills, hobbies, volunteer work and athletics. Scholarship application deadlines vary, with some due before your child graduates from high school. Visit your local library to find scholarships and use our Scholarship Success Guide to help your child improve the quality of his or her applications.

Next tab: "State Aid"

Previous tab: "FAFSA"

State Aid

Did you know Oklahoma provides millions of dollars in free grants and scholarships to qualified students each year? Our state offers several programs you'll want to check out:

Oklahoma Tuition Aid Grant (OTAG) Program

OTAG awards grants to Oklahoma students who need money to meet part of the cost of attending college or a career technology center. Students must submit the Free Application for Federal Student Aid (FAFSA), available Oct. 1, to apply for this grant. Grant funds may be limited, so the earlier you apply the better.Oklahoma Tuition Equalization Grant (OTEG)

OTEG awards grants to Oklahoma students attending eligible Oklahoma not-for-profit, private or independent institutions. Family income cannot exceed $50,000.Oklahoma's Promise

Students must apply for Oklahoma's Promise in the 8th, 9th, 10th or 11th grade, be a resident of Oklahoma, complete a specific high school curriculum, achieve at least a 2.50 GPA, and abide by certain conduct standards. Family income may not exceed $60,000 at the time of application and $100,000 at the time the student begins college and before receiving the scholarship. Applicants must complete the FAFSA before entering college in order to receive the scholarship. Oklahoma's Promise will pay resident tuition at an Oklahoma public institution, or a portion of tuition at an Oklahoma private institution, or tuition at a public technology center for courses that are approved for credit toward an Associate of Applied Science degree at an Oklahoma public college.Academic Scholars Program

The Academic Scholars Program awards scholarships to Oklahoma students who score at or above the 99.5 percentile on the ACT or SAT exam. It's also given to in-state and out-of-state students who are named National Merit Scholars or finalists, Presidential Scholars or Institutional Nominees (non-resident participation is limited).

Next tab: "Work-Study"

Previous tab: "Grants/Scholarships"

The Federal Work-Study Program

The Federal Work-Study program provides eligible college students with financial need the opportunity to work on or off campus and earn money for college expenses. The program encourages students to perform work related to their major, if possible. Like a regular job, students work set schedules and get paid hourly wages. Students must complete and request to be considered for work-study on their FAFSA application. Visit StudentAid.gov to learn about the work-study program and other types of federal aid.

Even if your child doesn't qualify for the Federal Work-Study program, working through school can be a great idea, provided your child can handle his or her responsibilities as a student, too. Every dollar earned is one less dollar your student will need to borrow. Many colleges offer part-time jobs to their students apart from the work-study program. Encourage your child to check with the campus's student life department to find out what's available.

Next tab: "Student Loans"

Previous tab: "State Aid"

Student Loans

Your child may need to consider student loans to help close the gap between money earned/saved and college expenses. Like any other loan, signing a student loan contract means your child is obligated to pay the borrowed money back. Even if a student doesn't graduate, every dollar borrowed must be paid back, with interest.

Your child may need to consider student loans to help close the gap between money earned/saved and college expenses. Like any other loan, signing a student loan contract means your child is obligated to pay the borrowed money back. Even if a student doesn't graduate, every dollar borrowed must be paid back, with interest.

If considering student loans, encourage your child to:

- Do the math.

There are two categories of loans: federal student loans and private loans (sometimes called alternative loans). If your child has to borrow to pay for school, note that federal loans often have lower interest rates and flexible repayment options. However, some private loans are becoming more competitive, so take the time to research the options and find the best program available. - Borrow only what's needed.

When accepting a student loan, your child should know how much money is actually needed to cover school expenses, including basic living expenses for the school term. Many students are offered more loan funds than they actually need. Remember that students don't have to accept all funds offered, and they should be cautious in pursuing additional loans outside those recommended by the financial aid office. - Be salary savvy.

Before accepting student loans, talk to your child about the starting salary for his or her chosen occupation. A good rule of thumb is to make sure the monthly student loan payments won't exceed 8 percent of the expected starting monthly income after graduation. - Avoid credit cards.

Encourage your child not to rely on credit cards for tuition or school-related expenses. Some families think it's easier to charge all college expenses to a credit card to avoid completing financial aid paperwork, but the interest on student loans is usually far less than interest on credits cards.

For more tips about student loans, visit ReadySetRepay.org and download the Borrow Smart from the Start brochure and their Save Money On Student Loans poster.

Previous tab: "Work-Study"